Buying a home on a $100k salary isn’t as easy as it used to be. With the average home price soaring past $355,000, a lot of buyers are left wondering if homeownership is even within reach. If you’re in that boat, trying to figure out a realistic home price that fits your budget, you’re not alone.

Even with a $12k down payment, you might find that your home affordability maxes out at around $300k, depending on your specific financial situation. And the truth is, your salary alone doesn’t dictate how much house you can afford. Other big factors—like your debt, credit score, location, and current mortgage rates—play a major role in shaping your buying power.

If you’re looking for a clear, data-backed answer to “How much house can I afford on $100k a year?” keep reading. We’ll break it all down, from mortgage calculations to the factors that lenders consider before handing over a loan.

To get to business, try our full-blown homebuying service evaluates your situation automatically. It will give you clear, personalized directions on improving your home-buying power. You can also try our free-to-use home-affordability calculator. Keep reading to learn the ins and outs of home affordability.

Key Takeaways

- It is typically estimated that someone who makes $100k a year can afford homes in the $240,000-320,000 price range.

- Your DTI ratio and credit score are, in fact, important for the mortgageapproval process from any mortgage lender, as well as your mortgage rate.

- Home affordability calculators can give personalized insight into the maximum amount you can afford based on your financials.

How Much House Can I Afford on a $100k Salary?

One of the foremost questions many potential homebuyers ask is: How much monthly mortgage payment can I afford on a $100,000 gross monthly income? Understanding your monetary limits is very important for future comfort and stability.

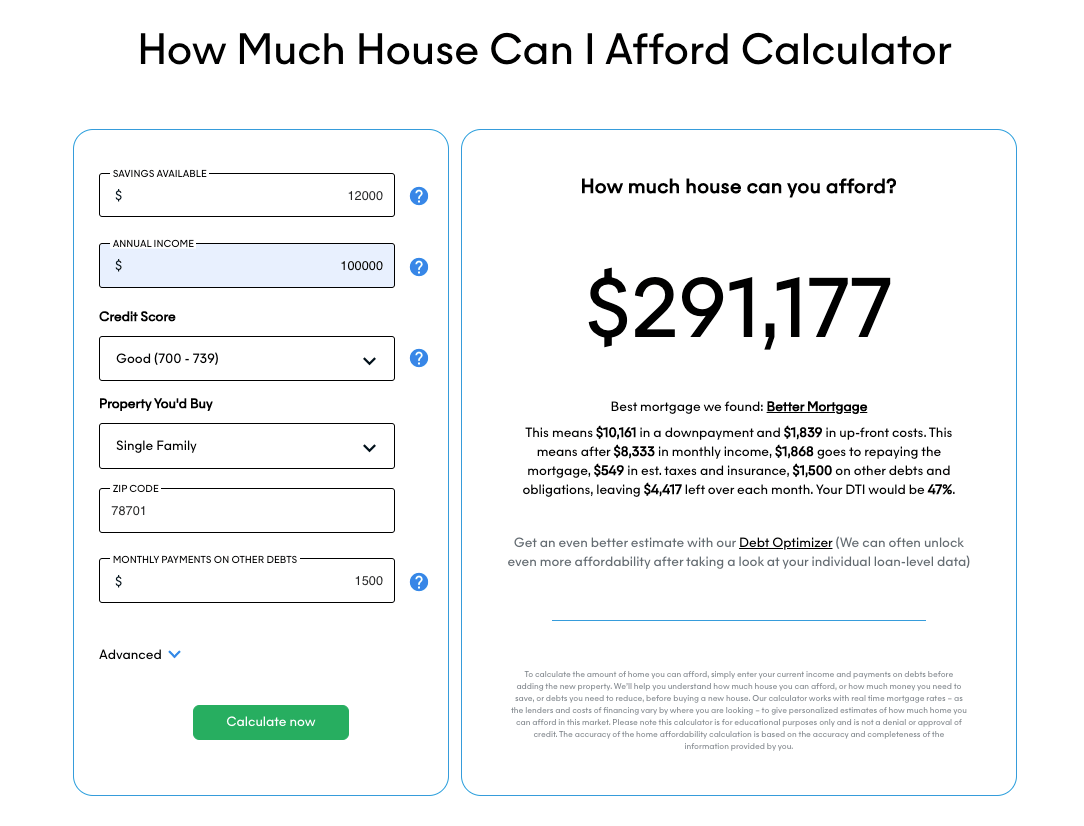

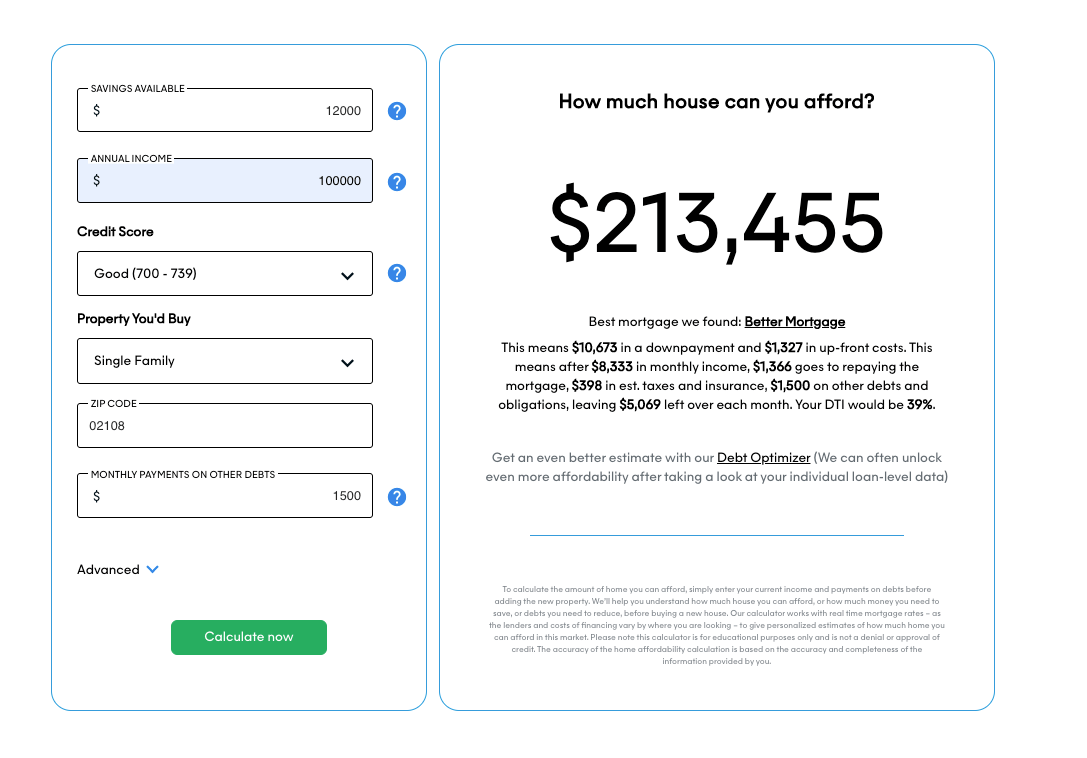

Let’s walk through a couple of examples from homeownership. For both examples, let’s assume our potential homebuyer has an annual salary of $100,000. The available savings of $12,000, a good credit score (700-739). This is with existing debt obligations (car payments, student loans, credit card payments) of $1,500 per month.

The first homebuyer is shopping for a home in Austin, Texas. The second is shopping for a home in Boston, MA.

How much House Can You Afford with a 100k Salary in Austin, TX

How much House Can You Afford with a 100k Salary in Boston, MA

a 100k salary usually equates to around $240,000 to $320,000 in home value- a figure that lenders usually estimate to be 3 to 4 times your income.

Remember, these numbers are purely hypotheticals, and how much housing expense you can afford with a 100k monthly income depends on many variables about your personal situation. Not only the amount of cash you earn each month, but a big factor is your existing monthly debt payments, and another is the amount of cash you have saved up.

Maximizing your home affordability is all about acquiring the right knowledge and tools, and that’s what we're here for. Our calculators take care of the hard work for you.

Let's dive deeper into the inner workings of our “how much house can I afford” calculator to understand how it helps you navigate the home-buying process more efficiently.

Principal Making Factors Affecting Affordability

There are several primary factors which affect what you can pay for a home loan:

Debt-to-Income Ratio:

Your DTI is a significant determinant of the mortgage you can qualify for. This ratio is calculated by dividing your monthly debt payments by your monthly gross income. Depending on your credit score, DTI can reach up to 50%, and many lenders are willing to accept higher ratios. This provides you with a stable income and a better credit score.

You'd ideally want your total monthly payment obligations if you make $100,000 a year (roughly $8,333 a month).This includes your prospective mortgage, which is less than $3,000. This compares your monthly debt payments to your income. Lenders prefer that it be at or below 36%, while some will consider up to 43% or even 50%

Down Payment:

A larger down payment will lower the loan amount, subsequently lowering monthly payments and interest. The size of your initial down payment significantly influences how much house you can afford. If you've already qualified for a private mortgage insurance amount, having more cash on hand allows you to afford a more expensive home.

A larger down payment amount for the same house price results in a lower mortgage rate, leading to smaller monthly payments, and this change greatly impacts your borrowing capacity and debt-to-income (DTI) ratio.

Credit Score:

A high credit score unlocks lower interest rates, meaning lower monthly payments and less money going towards interest. This compensates lenders for giving you money.

Interest Rate:

Speaking of interest and mortgage rates, the current market rates can drastically impact the total cost of your loan. A fraction of a percentage can equate to tens of thousands of dollars over the life of your loan, affecting the type and price of the home you can afford. The current interest rate greatly affects the monthly payments on your mortgage rate.

Loan Term:

A shorter loan term (say, 15 years) will have higher monthly payments but lower interest over the life of the loan. A shorter loan term (15 years) means higher payments, but the interest paid is less overall. On the other hand, with a 30-year term, the monthly payments will be less while the total interest is more.

Conversely, a longer-term loan (like 30 years) will have smaller monthly payments but more interest accrued over time.Your choice would depend on your financial comfort with monthly payments, and always remember that just because you qualify for a certain amount doesn't mean you need to borrow that much.

Always factor in other life goals, emergency funds, and lifestyle choices. It's all about balance.

For example, if you earn $100,000 per year:

- Monthly Gross Income: $8,333 (approx).

- Maximum Monthly Mortgage Debt Payments (36% DTI): $3,000.

On top of that, if you have $500 in other monthly debts, this leaves $2,500 for housing. With a rate of 4% on a 30-year fixed loan, you qualify for about $398,000.

While shopping for a new home, you’ve likely asked yourself one of the following questions: What is the best way to optimize my finances? How do I know if I’m overpaying for my mortgage? Where can I find the lowest prices for new mortgage loans and optimize my mortgage choice? How can I lower my debt to income ratio? With questions like these swarming your mind, you might feel like you're yearning for some unbiased personal financial advice.

How to Use These Affordability Calculators

For a more customized perspective, use the calculators above:

- Zillow Affordability Calculator: Estimates presented start off from income, debts, and down payment parameters.

- HSH.com Calculator: This helps you visualize the effects of each of these considerations on affordability.

Today, the finance world is saturated with resources, but it's challenging to differentiate between clickbait articles and legitimate financial guides.This aims to help you effectively manage your debts and optimize your finances. If you’re looking for a personalized answer to “how much house payment can I afford with a 100k salary,” you’re in the right place.

We provide unbiased financial advice that works for you, including free tools to get you started. This includes affordable, customized advice tailored to your needs.To explore different scenarios and get personalized debt advice, use the latest financial advisor technology tools like our Debt Optimizer to optimize your home-buying power, or our free Home Affordability Calculator to explore the best strategies for your financial goals.

To determine how much housing costs you can afford on a 100k salary, you need to determine your DTI ratio, down payment, credit score, and interest rates.Online calculators and financial planners can help you make smart decisions. This is in light of your journey to becoming a homeowner.

Frequently Asked Questions (FAQ)

Should I Buy A House Without A Down Payment?

Some lenders are willing to offer no-down loans. However, these programs may restrict eligibility to first-time buyers from low-income families or those requiring a high credit score. Loans may have higher interest rates or additional requirements.

How does my credit score affect my mortgage affordability?

The higher the credit score, the more you would score better loan interest rates. The lower your monthly payments, the greater the money you could borrow. In contrast, with a lower score, rates are higher, and affordability is decreased.

What other costs should I consider when buying a home?

The mortgage payments, property taxes, homeowners insurance, maintenance expenses, and any necessary homeowners association (HOA) dues.

How do interest rates affect my ability to purchase a home?

Even a slight increase in interest and tax rate may influence the amount that the monthly debt payment will increase. Thus, this reduces the total loan amount for which you can qualify.

Is it better to have a 15-year term or a 30-year term?

Typically, a 15-year term involves higher monthly payments from monthly income but would expedite the loan's payoff and incur less interest. This is less than a 30-year term with smaller monthly payments but more interest over the life of the loan.